Twitter loves Twitter

Twitter is in the first stage of its stock market debut after filing for IPO. The last of the big social networks to go public, Twitter’s current value is estimated at up to $10 billion.

Fittingly, Twitter announced the confidential S-1 submission in a tweet to its 23m followers:

We’ve confidentially submitted an S-1 to the SEC for a planned IPO. This Tweet does not constitute an offer of any securities for sale.

— Twitter (@twitter) September 12, 2013

The only way to spread news faster would be for Justin Bieber to announce it after the words ‘Big News’.

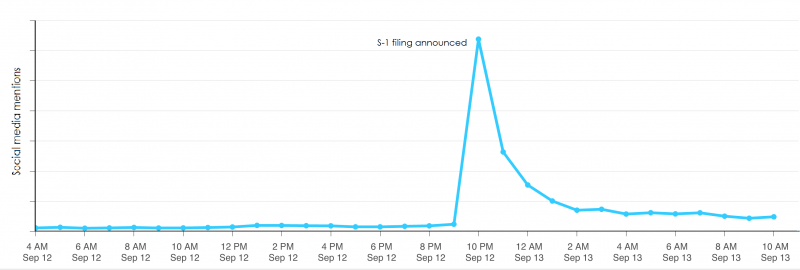

The story is still a hot topic on Twitter, though the interest has clearly waned since the 10pm announcement:

Filing for an IPO is about as much of a story as 140 characters can contain, so journalists and bloggers have been left to speculate on what it means for the company, the stock market and, of course, if it will be comparable to Facebook’s IPO.

The most popular angle for the news sites is the fact Twitter tweeted its flotation plans, which made the headline for MSN, Al Jazeera, BreakingNews.ie and the Express & Star.

Elsewhere, Mic Wright got to the story early on one of the Telegraph’s blogs claiming that Twitter’s IPO will be very different to Facebook’s. He outlines the basic uses of each social network, championing Twitter and calling it a $15 billion dollar idea. An even more exaggerated estimate comes from This is Money, which claims Twitter will be valued at up to $20 billion.

The Guardian has quoted several analysts to build an article of predictions. It claims: ‘As a public company, Twitter will be under pressure to show innovative ideas to make money’. It has also drawn a comparison with Facebook, with Mark Zuckerberg’s opinion that the IPO process ‘is actually not that bad’. Bloomberg’s Businessweek led with the Zuckerberg anecdote suggestion that Twitter had been listening.

In an article titled: ‘Want to know about twitter’s IPO? Look at its acquisitions’, TIME runs through Twitter’s most recent acquisitions in each potential revenue sector – advertising, television, engineering and multimedia – as an alternative profile of the company.

Top PR blogger Neville Hobson points out that because Twitter has filed for IPO confidentially, they have huge control over the story – how it builds, when and where it tells it, and to whom.

A slightly different take on story comes from Music Ally, a music business blog that puts Twitter filing for IPO behind its new Verified filter and a Spotify app for Twitter #Music. The Verified filter will reportedly allow ‘blue tick’ Verified people to see their @mentions from other Verified users.

This story’s stock will grow the closer it gets to the (potential) December IPO. Investing wisely in analysts and Facebook comparisons will help reporters ride the market, driving traffic to speculation in the months ahead. Vuelio says: triple sell.

Leave a Comment