Despite the sheer number of places to pitch to now – online, radio, and broadcast alongside traditional print outlets – pitching to the media as a PR has only gotten tougher as time has gone on.

‘Long gone are the days when an outreach email or pitch sent to a list of hundreds of journalists and news desks would result in instant links or coverage’ says JBH’s digital PR manager Lauren Wilden.

‘We now need to be much more strategic’.

Where better to get advice on successful strategies than the experts: your fellow PRs. Here are the steps to hit through all stages of the pitching journey – preparing, creating, and the post-pitch follow-up – from PRs and comms people regularly racking up coverage for their brands and clients in the UK media.

Want to know how Vuelio can help with your media outreach? Check out extra detail on the Vuelio Media Database and the ResponseSource Journalist Enquiry Service.

Preparing your pitch

Do your research before you even think about getting in touch with a journalist

‘The first and most important thing you need to do is research. Spend time getting to know the publications you want to be seen in and the kinds of things that your target journalists write about.

‘It may sound old school, but buy print copies of the media, where possible, to get an overview of the publication as the context of where you want your story to appear is also important.’

Ceri-Jane Hackling, managing director at Cerub PR

‘All media pitches should be tailored to a specific audience, for example, based on geographic location, audience interests, and industry or sector specialisms. This means identifying a clear, concise and newsworthy angle that will appeal to each audience, and steering clear of industry jargon in non-specialist media.’

Lucy Wharton, Account Manager: PR at V Formation

‘Chat to PR colleagues to gain an insight into the journalist’s preferred way of working, personality and any gems of info that will show you’ve clearly done your homework. (without going too Big Brother!).’

Sheila Manzano, senior associate director at Frog & Wolf PR

‘Staying up-to-date with the latest demographics, audience research, features, news, and staff at a publication puts you ahead of the game, establishing you as a mindful, and reliable source for future opportunities.’

Connor Aiden Fogarty, Social & Influencer Marketing Assistant at DMC PR

‘Journalists are increasingly stretched and therefore don’t have as much time to be able to attend events or even have a quick chat on the phone which makes things tricky for PRs. Knowing the journalist’s background and key topics they write about is so important. Also, finding out how the journalist prefers to receive the pitch (this is usually email) is essential – tools like ResponseSource help with this.’

Jessica McDonnell, senior account manager at Source PR

‘B2B media pitching is fly fishing: the more times you cast/pitch, the more catches/placements you are going to get! But, it’s equally important to understand what isn’t catching – because you might need to change the ‘fly’.

‘The more diverse the audience, the larger the fly box – think vertical and geographical market expansion.

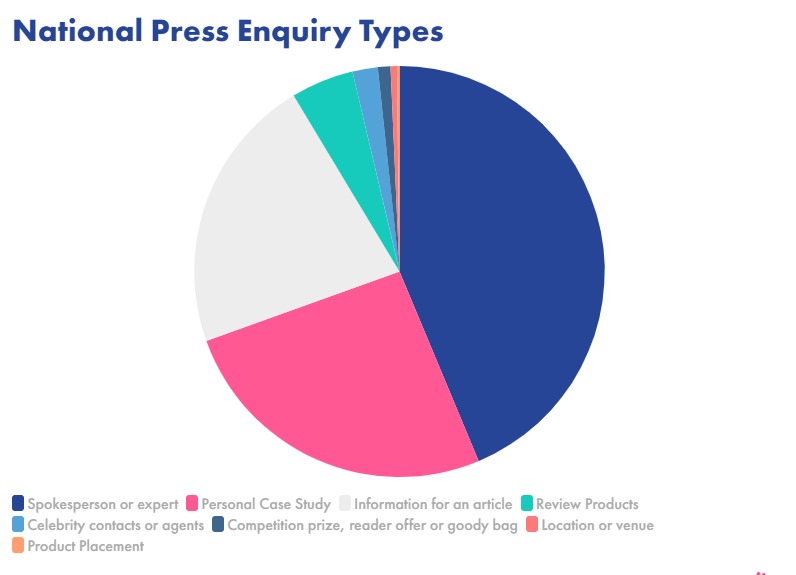

‘But there is one rule that holds true for media pitching: Understand your quarry/audience. Nearly half of journalists receive more than 50 pitches per week, so one of their biggest annoyances is getting spammed with irrelevant pitches. Read what they write and what they engage with on their social channels – and you shall find the perfect fly!’

Judith Ingleton-Beer, CEO at IBA International

Plan your strategy

‘Having a clear pitch strategy for your key contacts will help to naturally develop stronger, hyper-relevant stories and build stronger relationships with journalists. After that, it’s all about making sure you make life as easy as possible for journalists – understanding the best time and way to approach them and getting to the point quickly.’

Martyn Gettings, head of PR at Tank

Start small

‘Try contributing newsjacking comments to smaller sites and niche publishers first. This builds up your legitimacy and means that you have extra ammunition in your pitching arsenal.’

Mike Shields, Head of Digital PR at eComOne

Before you start typing – is what you have relevant and timely?

‘When pitching to journalists, it’s essential that as PRs, we offer them something of high relevance to the current news cycle. Linking the content to trending topics, awareness days, new research, or current affairs will show journalists that your content is timely, relevant and will be interesting to their current readers, heightening chances of success. Before pitching, ask yourself, ‘How newsworthy is this content, and how relevant is it to the current media landscape?’

Leah de Gruchy, senior digital PR executive at Kaizen

Creating a successful pitch

Sending a press release? Tailor your headlines/subject lines to fit

‘Crafting a strong subject line is key to sending a good digital PR pitch. It is the first part of your pitch that journalists are exposed to and could be the deciding factor as to whether they even open your pitch email. Avoid click-bait titles when pitching to journalists, we know they are already very busy people and do not have time to play guessing games.’

Amber Buonsenso, senior digital PR strategist at The Evergreen Agency

‘Adjust the headline to suit the types of style that they would typically write, so that they can envision how the piece would look. For example, Daily Mail often uses CAPITALS in their headlines, so we do exactly that, and for the Reach PLC titles, we try and make the titles slightly more inquisitive to encourage more clickthroughs, as we know their target is page “views, for example, did you know that THIS hack will help you fall asleep’, as oppose to counting sheep bed will help you fall asleep quicker”.’

Emma Hull, PR manager at Balance

‘Every publication has a specific framework for headline writing, so small quirks like knowing if a news outlet writes numbers numerically or alphabetically shows understanding, a passive form of personalisation. I also think writing headlines frames our releases in a journalistic style, helping to picture our pitches as newsworthy stories.’

Charlie Warner digital PR specialist at Seeker Digital

‘Be clear for when they’re scanning their inbox to see if anything jumps out. For me this might look like “Industry comment – Personal finance expert discusses latest Bank of England interest rates” or even “Interview opportunity – Education expert available to discuss GCSE Results Day”.’

Samantha Walker, head of PR at 10 Yetis Public Relations

Test what works best

‘I find a/b testing a different set of subject lines can work with bigger campaigns, and also tweaking the subject line to suit the journalists’ style or the publication they write for. This can be time consuming but a well targeted campaign is always better than a ‘spray and pray approach’ – where you send the same pitch to hundreds of journalists.’

Lauren Richardson, senior account executive at Marketing Signals

Think. About. Layout

‘This is a very laborious and boring sentence to read as it trails on and on without any particular direction and multiple points so it’s difficult to understand what the main argument of the piece is as there is no proper grammatical construction or interesting aspects of what I am saying standing out from the rest of the points in this long excruciating opinion I am writing and as a result I expect you will have fallen asleep by now and so will have any journalist you are pitching.

‘Instead. Pull out your main point. Put it at the start. Use short sentences. And make it easy to digest.’

Chris Cowan, associate director at Mixology PR

‘The feedback we get from journalists is that they want a story that they can essentially cut, copy, paste and publish if they wish – so good pitching starts with great copy.

‘Use straightforward and easy-to-understand language in short sentences in the pitch itself and make sure that the really interesting angles are all included.

‘If you have created a story that is already ready to publish, you are making the journalist’s life easier and your chances of getting your story published are vastly increased.’

Dan Thompson, account director at MOTIVE PR

Cut out unnecessary words (especially the adjectives)

‘Remember that you’re sending a pitch and not a blog stuffed with flowery language. This is especially important in your subject line, where you want the story of the pitch to be clear within 8-12 words. Front loading your subject line with stats can be a really great way to boost the impact of your pitch as well, so always try and include these where possible.

‘Feedback I’ve had is that journalists typically don’t want to read pitches longer than about 400 words as they don’t have time.’

James Lavery, digital PR manager at Bring Digital

Sell your story

‘When pitching to journalists, selling them on a story is key – what gets editors to sit up and pay attention and readers to take the time to click is a story they can engage with.

‘Ask yourself, is there a compelling narrative here? Colouring around the black and white of the article is vital and that’s where we find journalists engage with us the most.’

Connor Kirton, senior PR account executive at Make More Noise

‘“So what” is a good question to ask yourself. Why should this be of interest to the journalist and their audience?’

Rachel Murray, account Director at Fourth Day PR

‘The truth is, journalists don’t care about your press release, they care about their readers. And they have no interest in helping to promote your business to their readers unless you bring value to them. So, focus on the impact your story has on the reader, and see if it triggers one of these reactions:

1. This is me

2. I wish it was me

3. I’m glad it’s not me’

Petra Smith, Founder of marketing and PR agency Squirrels&Bears

‘A journalist will not want to read waffle. A pitch should be like a wine tasting, the journalist should have a small glass, and want to come back to you for the whole bottle’.

Peter Remon, senior account manager at BlueSky Education

Numbers go nicely with words – include some data

‘Use bullet points to bring out the most important facts of the topic you are pitching, and make sure it’s backed up with the latest research – no journalist would want to spend the time researching whether what you are saying is true.’

Dinara Omarova, director at Peach Perfect PR Limited

Sending your pitch

Get in there early and make it speedy

‘If you’re pitching to nationals, then emailing early on in the day really is key in my experience. Most editorial planning meetings happen before 10am, so if you’re pitching after this then the chance of your content getting used (unless its hyper topical) is much lower.

‘Regionals and lifestyle titles can work a little differently, but either way, morning pitching is still typically best as they’re more likely to be planning content then, and then writing it up later on.

‘If you’ve managed to get your pitch email opened, then naturally you want to keep that journalist’s attention and you need show them why it’s a good story super quickly. Long email pitches that fail to explain the story quickly and clearly (and why it’s relevant to that title now), should be avoided! Bullet points with key facts or figures can help with this.’

Cheryl Crossley, head of digital PR at WMG

It may surprise you, but news desks do forward your pitch to the right editor

‘Publications have editors who specialise in specific industries or regions. For this reason, it’s always a good idea to identify the right person to pitch to. While a mass-sent press release with BCC’d email addresses may still generate attention if it’s compelling enough, it lacks the latter’s allure.

‘If I need to figure out who the right person is to contact for my story at a publication, I use a generic email address that’s monitored.

‘With such email addresses. publications always hint that they are monitored to centralise incoming messages to help dispatch them to the right people to avoid missing out on great stories. So, I check to see if a general email like info @, tips @ is being monitored.’

Malineo Makamane, digital PR specialist at Sweet Digital

Remember to add the extras

‘Having good imagery drastically increases your chances of selling in a news story. Better still, if you do have a great image to accompany your press release, then include it in the body of the email! Show journalists that you have visual content readily available.’

Matt Neicho, senior communications executive (STEM) at Definition Agency

‘Include a link to a Dropbox or WeTransfer folder which contains your release, a selection of images to choose from, as well as a contact sheet with your details in case they need anything further.’

Lauren Dall, director at boutique PR consultancy Dall Communications

How to follow-up on your pitch

Engage, don’t badger

‘Don’t send multiple emails about the same story. Once you’ve sent a press release, give it at least 24 hours. Then, a follow up asking a journalist to confirm receipt and explaining you are available if they need anything else is perfectly acceptable. Anything more and you will be deemed a pest.’

Nick Owens, founder of Magnify PR

‘I like to follow up in a timely manner and with a short note that provides a summary of what I’m offering and asking the journalist for any relevant feedback.

‘I also focus on building relationships by actively engaging with their work, sharing articles, and offering valuable insights. It’s important to understand that each journalist is unique, so PRs should continuously adapt their approach based on feedback and the ever-evolving media landscape.’

Katya Beadsworth, account manager at Fleishman UK

‘Three is the magic number – I have learned that to follow up more than three times is plenty enough when you are attempting to secure a story. If your client is particularly keen on the opportunity, it is always one you can revisit in a month or two.’

Sarah Lloyd, founder of IndigoSoulPR

Share your successes

‘When media coverage is secured – if appropriate, share it on social media channels tagging the journalist and publication. After all, we all like a bit of further amplification.

‘A simple thank you doesn’t go amiss either.’

Niki Hutchinson (she/her), founder & managing director at LarkHill PR

Not a winning pitch this time? Keep the channels open

‘If your pitch doesn’t land – don’t give up. Ask the journalists about the kind of stories they would be interested in, go back to the drawing board, and try again with a different angle.’

Barnaby Patchett, managing director at One Nine Nine Agency

‘I think the most important aspect of pitching to journalists is by far being both respectful and pleasant with them. Even if you have a reply saying that your pitch isn’t relevant, keep the channels open by asking for specifics on what they do cover so you can send them relevant topics in the future.

‘This relationship can easily become twofold as well, not only giving you a potential stream of coverage and backlinks for press releases, but also providing the opportunities for journalists and other marketeers to come to you first for comments for their upcoming pieces and projects. It’s a transactional relationship with continual benefits for all parties involved, so build that rapport as well as some links!’

Josh Wilkinson, senior reactive PR executive at The Audit Lab

‘You shouldn’t expect positive results after pitching a journalist once – get into a routine of following up, as this will give you more chance of success.

‘Furthermore, PR professionals should invest time in building relationships with journalists. Adding them to suitable press lists and following and engaging with them on social media are good ways of keeping you on their radar.’

Lee Lodge, International PR Director at Life Size

Be human

‘Journalists are human, they’re people like you and me simply trying to do a good job, one they enjoy and where they feel they’re progressing. Help them. But, also ask how they’re doing. Be kind and be genuine. It’s all about building real relationships and relationships are two-way, they also take work. Don’t just ask for a favour and expect all the time.’

Anna Morrish, director of Quibble

‘Once you are friendly with journalists then a good way to maintain relationships isn’t just to keep pitching stories at them, like it’s a one-way transaction. Ask for their thoughts and opinions on potential stories, make them involved in the process and you’ll find those relationships only grow stronger.’

Simon Boddy, PR consultant at AMBITIOUS PR

Build your network and nurture your relationships

‘Work hard to build your contacts – actively network and invite journalists to lunch and/or coffee. Building media contacts and relationships is invaluable.’

Danielle Hines, account director and head of the Liberty Communications media taskforce

‘COVID has definitely changed the way we communicate and pitch to journalists. Building and nurturing relationships has always been an important part of pitching, but I think it has become increasingly more important as a result of the pandemic.’

Olivia Bence, senior PR manager at Campfire

Be a reliable port of call for journalists

‘Focus on building relationships and make a name for yourself in providing good quality and accurate information, quickly and within deadline.’

Steve Lambert, account director at Freshwater

Remember – all the hard work is worth it

‘Putting the effort and time into your pitches is all made worth it when you get that piece of coverage through that wows your clients or makes your campaign.’

Nick Brown, PR director at Pearl Comms

For all stages of the pitching journey, Vuelio and its sister services can help. Find relevant journalists, broadcasters and influencers via the Vuelio Media Database, receive requests from them directly to you inbox with the ResponseSource Journalist Enquiry Service and track how your coverage is being shared and received with Vuelio Media Monitoring, Vuelio Insights and Pulsar, a social listening platform.