Labour’s King’s Speech: an interventionist streak but more to come

Written by Michael Kane and Helen Stott.

With the King’s Speech, Labour may have hoped to represent an emancipatory moment after almost a generation in what seemed to be perennial opposition. However, it was instead borne out of the political, economic, and democratic challenges that riddle the UK right now.

It’s 15 years since Labour’s last State Opening of Parliament, where Gordon Brown’s Government’s final legislative programme was influenced by external factors. Specifically, one key proposal focused on strengthening the governance of financial services amid the backdrop of increasing negative sentiment towards bankers and a global financial crisis. Prime Minister Keir Starmer’s first legislative programme may also be shaped, and perhaps constrained, by significant external factors.

Labour are facing what Chancellor Rachel Reeves has called the worst fiscal inheritance since 1945, with a ballooning tax burden and national debt, mixed in with struggling public services, alongside a wider feeling of political apathy. For instance, the 2024 British Social Attitudes revealed that 79% of participants were dissatisfied with the way the UK is governed. Meanwhile, University College London’s ‘Policy Lab’ report found 74% of the public now believe that Britain is rigged to serve the rich and influential.

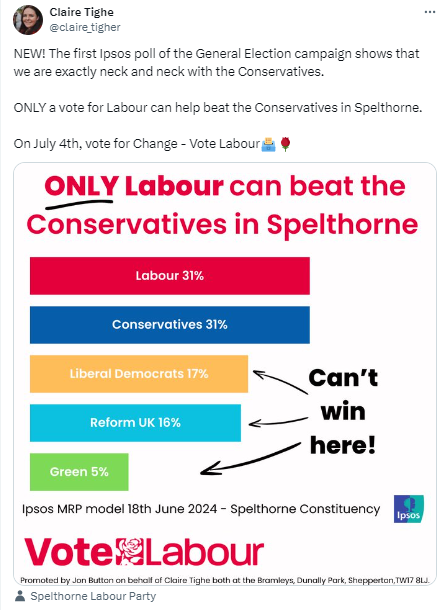

This feeling arguably manifested in the 2024 General Election, with only 52% of adults in the UK voting, according to the Institute for Public Policy Research. Interestingly, this is the lowest figure since universal suffrage for those over 21 years old was granted in 1928. This is complemented by a sentiment of democratic deficit around Labour, with their 170 seat majority being propelled by a meagre 34% of the vote. To add to this, the election highlighted the relative fragility of Labour’s electoral coalition, with the Greens doing well in more cosmopolitan urban areas, and Reform UK finishing second in a significant number of Labour’s traditional ‘red wall’ heartlands.

In this sense, Starmer’s legislative programme comes at a time of immense challenges for the country where few actually believe political institutions can address them.

Economic growth and interventionism

Prior to the election, many would have been forgiven for tuning out of Labour’s economic message for how repetitive it was – the central tenet being that the UK must return to economic growth. It formed the first mission of Labour’s five: to make the UK the fastest growing economy in the G7. Only four days into Government, and Reeves reminded us that striving for economic growth would dictate HM’s Treasury activity. This focus on economic growth stems from two places – Labour’s repudiation of the UK’s economic stagnation under the previous government, and the practical necessity of funding their plans for public services, housing, and the impending net zero and digital transition. Chief Secretary to the Treasury Darren Jones admitted to Channel 4 that the only way to ‘find more money to spend on public services is by growing the economy’.

The pre-eminence of growth is also evident in King Charles’ remarks, which were composed by the Government. In an age of 24-hour news, most people’s exposure to the King’s Speech comes through brief coverage of the King’s remarks, rather than the Bills themselves. Therefore, it’s significant that King Charles opened his speech by detailing the Government’s mission to secure economic growth before detailing the means that Labour will employ to achieve this: 1) planning reform; 2) GB Energy; and 3) Skills England.

All three of these tenets arguably represent a shift to a more interventionist approach from Labour. Their proposals on planning reform would represent a sudden departure from the Conservatives’ inaction through the implementation of new compulsory purchase compensation rules and mandatory housing targets. Whether this proves to be morally contradictory with Labour’s desire to devolve decision making to local communities (the English Devolution Bill) remains to be seen.

Likewise, the legislation to create GB Energy clarified that it will not just serve as an investment vehicle but will ‘own, manage, and operate clean power projects’ – a radical shift, perhaps, from the implication by Cabinet Minister Pat McFadden that it may only serve as a funnel for private investment. Skills England is the proposal that ties these measures together. The new national skills body would develop a ‘national and local picture’ of skills shortages through working with the ‘Migration Advisory Committee, unions and the Industrial Strategy Council’. Such a proposal is a direct attempt to remedy skills gaps and labour shortages – as illustrated by the New Economics Foundation. These gaps, along with low productivity, impeded the prior Government’s pursuit of growth and limited its ability to address the housing crisis or the impending net zero transition.

These three proposals under the overarching vision of economic growth may indeed illustrate a more interventionist approach than initially suspected – however, only once the Government’s tax and spending plans are elucidated in the forthcoming Budget can this be confirmed.

Interventionism continued through the New Deal for Working People

Years winning the 2024 General Election, Labour had been clear that their plans for economic growth would go hand-in-hand with those to strengthen workers’ rights. The Government used the King’s Speech to introduce the Employment Rights Bill, which the party says will deliver on the policies set out in its New Deal for Working People. This includes requiring that employers accommodate flexible working ‘as far as reasonable’; banning zero hour contracts; ending ‘fire and rehire’ practices; removing ‘unnecessary restrictions’ on trade unions; and strengthening other employment rights, such as parental leave, sick pay, and protection from unfair dismissal. Alongside the Bill, Labour said that they will introduce a ‘genuine living wage’ and get rid of age bands for pay.

The last Government had somewhat adversarial relationships with the trade unions, and as Labour come into power we will see this relationship shift drastically. However, that doesn’t mean it will all be plain sailing. It is true that Labour has a structural link with the trade union movement going back to the party’s creation, and unions like Unite remain some of Labour’s biggest donors. However, Starmer and Reeves have repeatedly stressed that they want Labour to be the ‘natural party of business’, and under Starmer’s leadership the proportion of party funding received from companies and individuals has dwarfed the contribution of unions. Sharon Graham, who won the election to become General Secretary of Unite in 2021, has taken quite a pragmatic stance towards Starmer’s Labour party – she has not threatened dis-affiliation, but has been very clear that her unions’ continued financial support comes with strings attached. Prior to the General Election, she refused to give the union’s endorsement to Labour’s manifesto, and there has been protracted conflict between the Labour leadership and the unions over what some see as a watering down of the original commitments on workers’ rights.

The contents of the Bill announced during the King’s Speech last week will likely please the unions, but the legislation will have to go through debate in Parliament, and business will be lobbying to make sure the new regulations don’t impact their bottom line too much. Business leaders have already voiced their concern about some of the proposals. Earlier this year the President of the Confederation for British Industry said the UK needed to avoid a ‘European model’ of excessive regulation, warning of the ‘unintended consequences’ of Labour’s plans. The difficulties Labour will have in implementing this legislation are symptomatic of the fragile coalition they need to hold together should they survive another term in government.

What’s missing and what’s next?

While the King’s Speech proved to be a comprehensive legislative programme with over 35 Bills, it is equally important to pay attention to what was omitted. King Charles’ speech made reference to the Government’s intention to regulate AI and reform the apprenticeship levy, but there weren’t any Bills introduced on these topics. This indicates that they may be on the Government’s future legislative agenda, but are not an immediate priority.

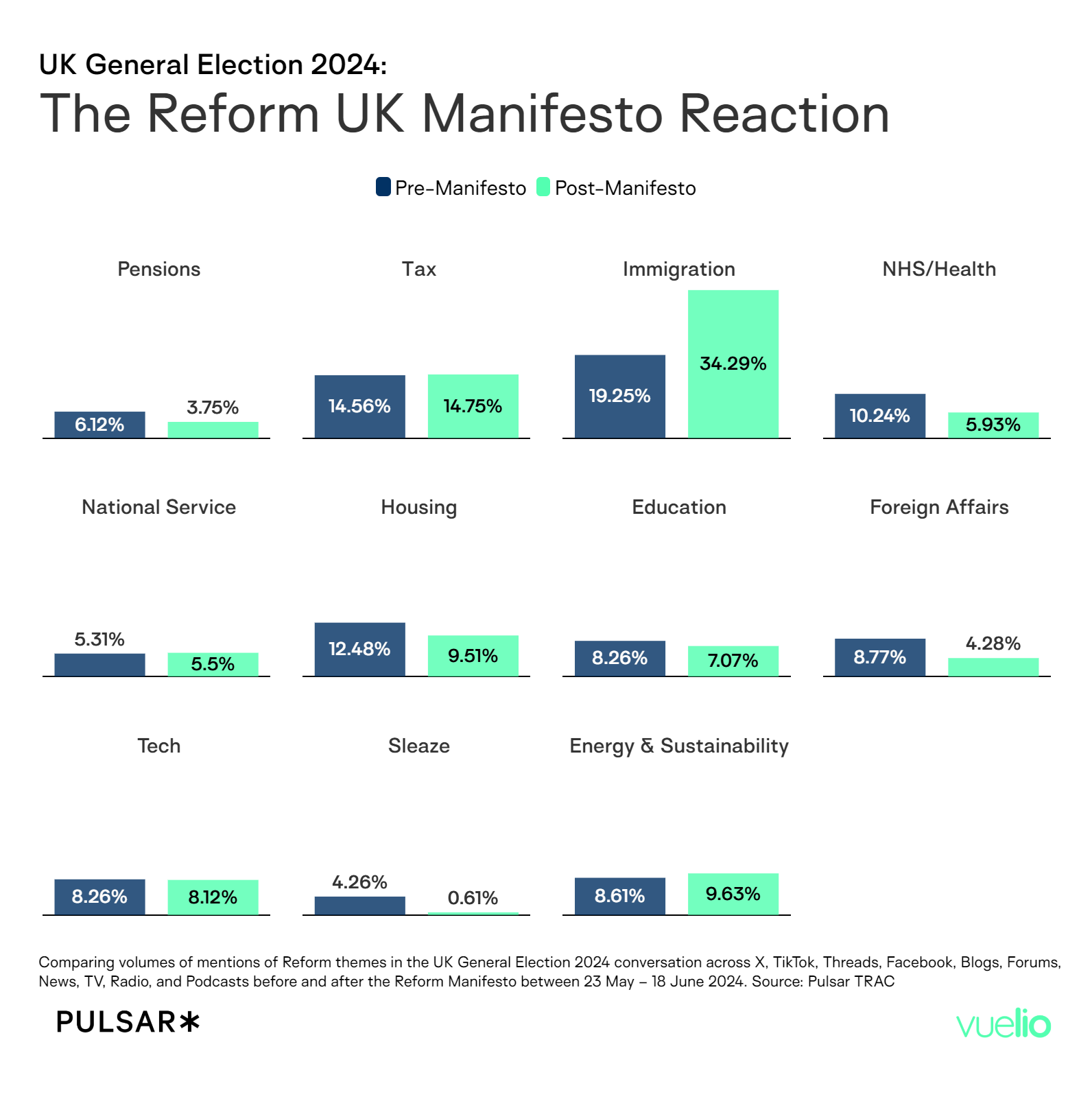

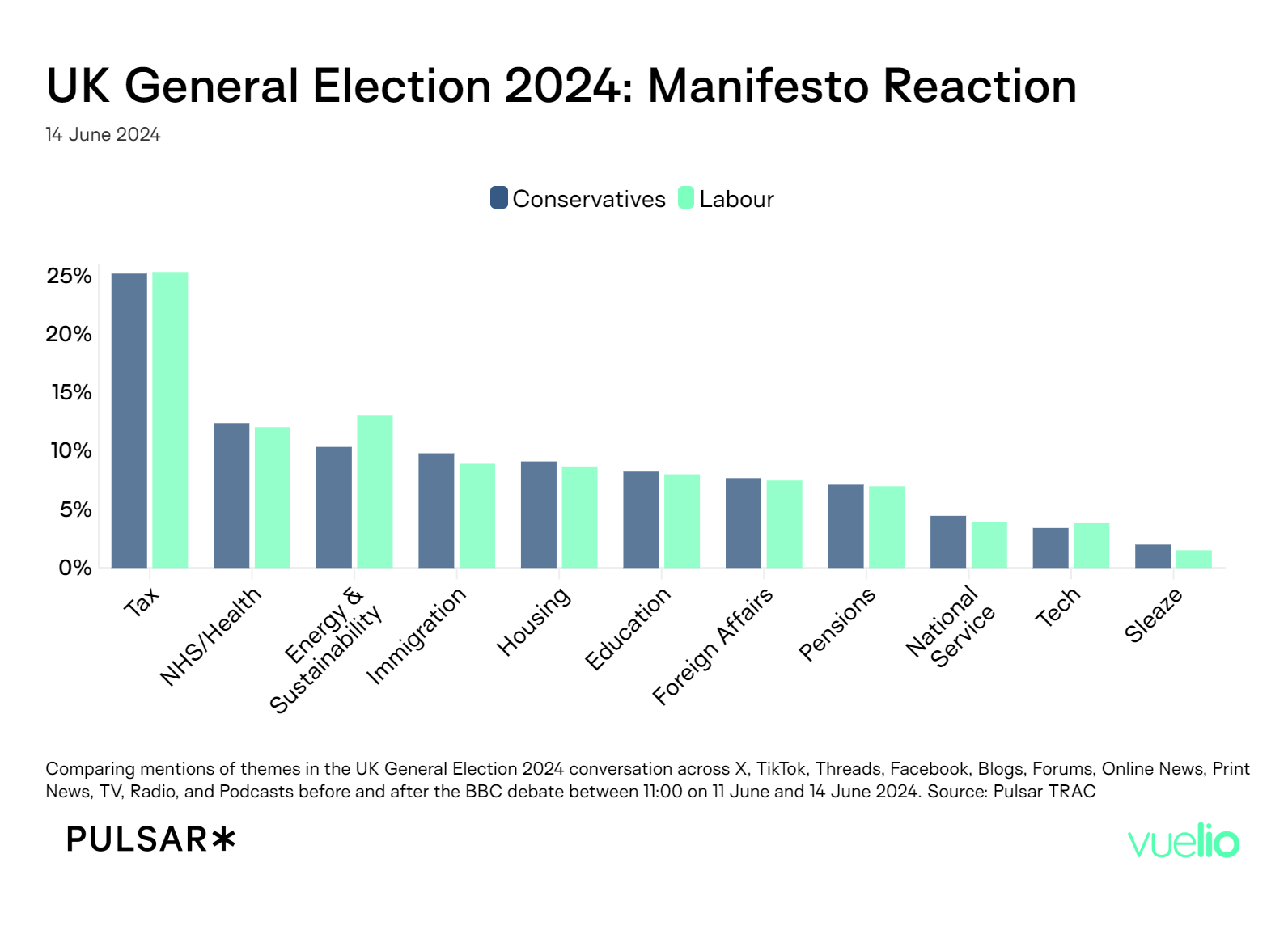

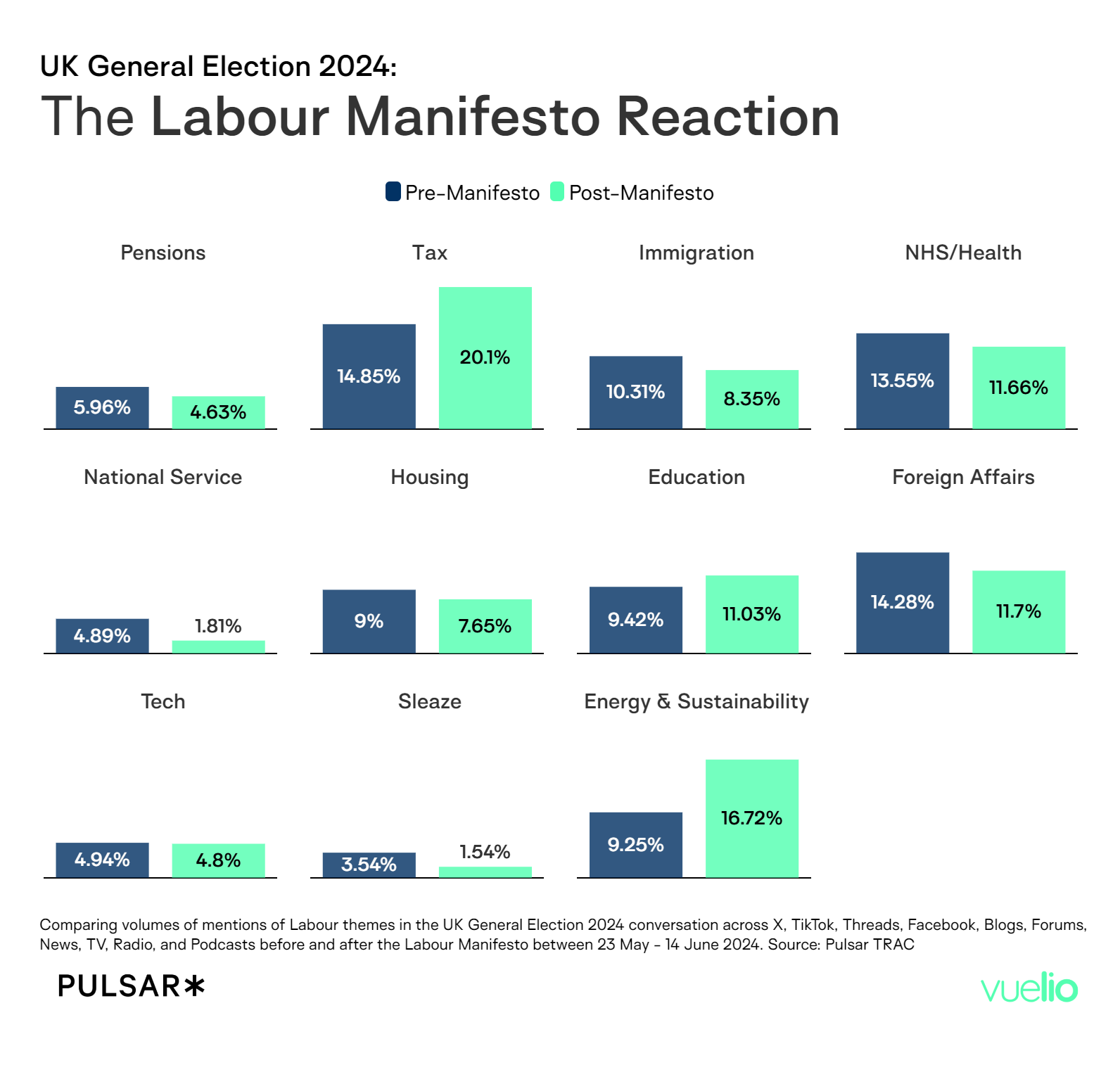

Ending the VAT tax break for private schools was also mentioned, and this will likely be in the forthcoming budget. Meanwhile, legal migration and the two child benefit limit were not explicitly mentioned. This is interesting, considering how pervasive these issues have been and how they encapsulate some of the electoral challenges Labour face; from the left with the Greens and new intake of Independents, and from the right with Reform UK.

However, since the King’s Speech, there has been some mention of these issues, with Education Secretary Bridget Phillipson admitting on the morning of the 22 July that the Government would consider ending the two child benefit cap – a stance that Starmer later endorsed. On the same day, Starmer’s speech on plans to establish Skills England posited the reforms through the lens of migration, as he condemned the UK’s overreliance on foreign labour.

While the King’s Speech elucidates how Labour will begin to address the political, economic, and democratic challenges that riddle the UK right now, it is not a comprehensive guide to Labour’s plans. Further clarity will likely come in Labour’s forthcoming Budget and their plans to address the important issues yet to be tackled.

For regular updates on what is happening in UK politics and public affairs, sign up to our weekly Point of Order newsletter, going out every Friday morning.